By Dennis Rousseau, founder and president of AircraftPost.com. This article was originally published in the Aircraft Bluebook Marketline Fall 2015 edition.

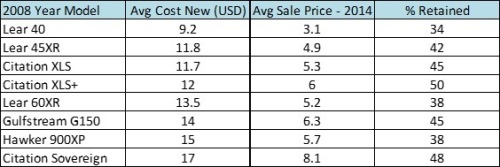

In 2006, the average cost new for a Pro Line 4 equipped Lear 60 was ~$12.5M. In 2007 the Lear 60XR entered service with the Pro Line 21 avionics and an average cost new of ~$13M. The $500K delta basically gave the operator a Pro Line 21 cockpit and redesigned interior. The engines, fuselage, empennage, etc. were unchanged and both aircraft certified under the same type certificate (TC), A10CE. In the last few months a 2006 Lear 60 sold for $3.8M and a 2007 Lear 60XR sold for $3.8M.

A 2007 Hawker 850 with 731-5BR engines had an average cost new of ~$13.5M and today has a resale value of $4.5M. A 2007 Hawker 900XP with 731-50R engines sold new for ~$14.5M and has a resale value of $5.4M. Other than engines, the aircraft are near identical (interior / exterior, Pro Line 21 cockpit…) and have the same TC (A3EU). All things considered, the above-mentioned facts represent quite an interesting scenario for value retention and age-based depreciation.

However, when the original cost new price point exceeds the $20M mark, the results portray a different picture, regardless of the manufacturer. In 2005 Dassault delivered the CFE738 powered Falcon 2000 with the Pro Line 4 cockpit (CRT displays) for ~$23M. The same vintage Falcon 2000 equipped with the EASy cockpit and P&W engines had an original price new of ~$25M. In the last few months a 2005 legacy 2000 sold for ~$10M whereas the same vintage 2000 EASy averaged ~$14M. Once again, the same type certificate (A50NM), fuselage, empennage and interior… a $2M delta when new, yet a $4M spread 10 years hence.

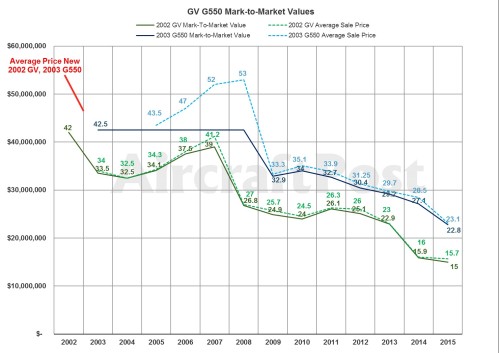

The Gulfstream GV and G550 are another example of this price divergence. A 2002 GV had an original price new of ~$42M. Its successor, the G550, had an average price new of $42.5M in 2003. The primary difference between the aircraft was the introduction of the Plane View cockpit, replacing the CRTs in the GV with 4 LCDs in the 550. Both aircraft shared the same TC (A12EA), fuselage, wing, empennage, etc. The average selling price today for the 2002 GV is $15M compared to the 2003 G550s $23M. The Challenger 604 (Pro Line 4) and 605 (Pro Line 21) follows a similar pattern. However, as large as the pre-owned price spread seems, with global economic conditions worsening and new aircraft deliveries slowing, it’s only a matter of time before the divergence becomes a convergence and aligns with the original price spread when new.